TDS rules while buying property from NRI

While buying property from NRI, the buyer must deduct TDS while making payment to the seller. This TDS has to be deposited with the income tax department. The remaining amount can be paid to the seller.

The TDS should be deducted not only on the final amount but on every instalment paid to the seller. Even on the token amount to be paid to the seller, this TDS should be deducted as per the income tax rules.

This TDS is charged at a rate higher in case of NRI seller. In case of a resident seller, you can click here to check the TDS rules.

Various scenarios –

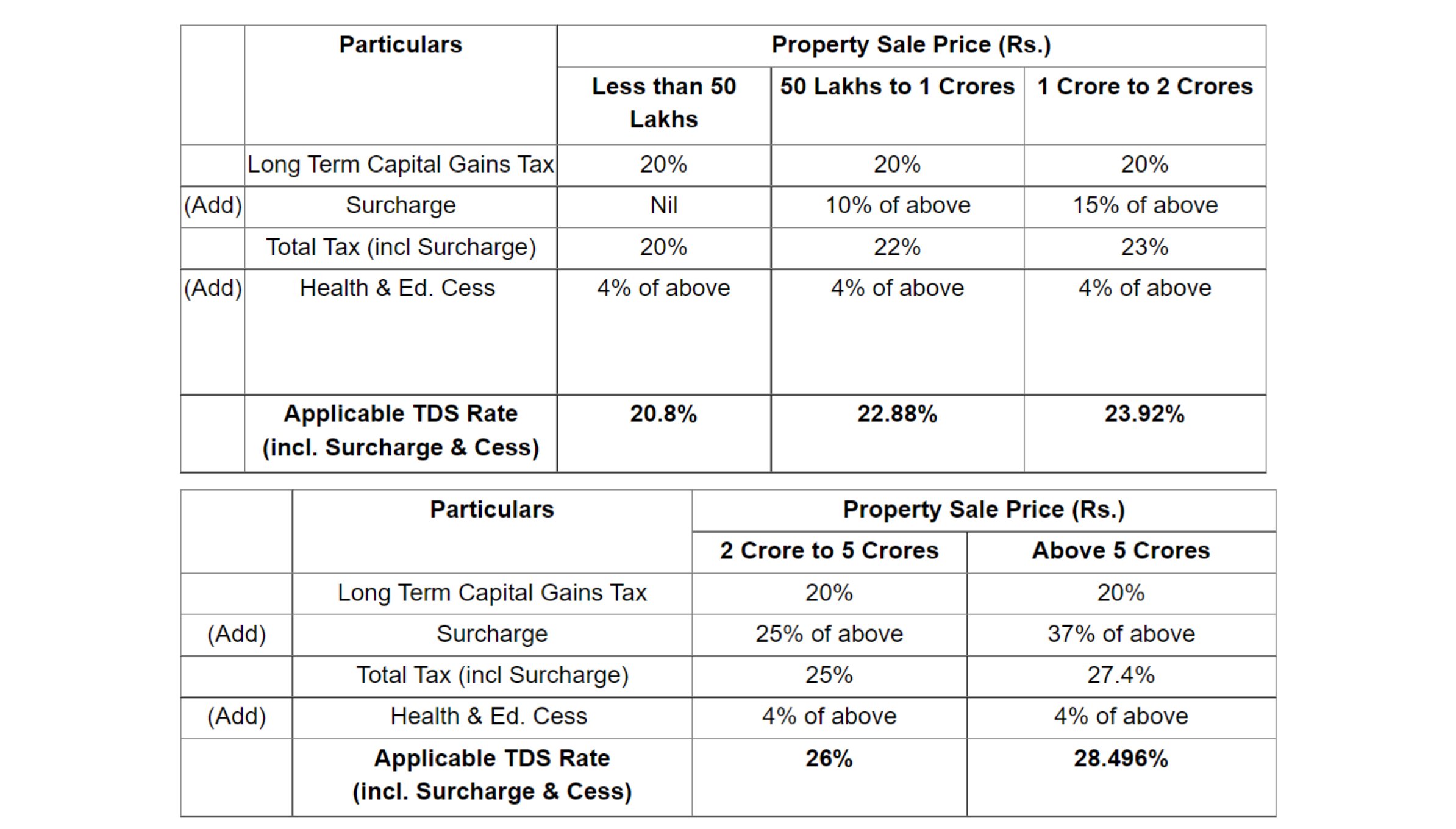

1. If the property has been held by the seller for more than 2 years, the seller has to pay long term capital gains. In such case, the buyer must deduct TDS @ 20% irrespective of the sale price.

2. If the property has been held by the seller for less than 2 years, the seller has to pay short term capital gains. In such case, the buyer must deduct TDS as per the income tax slab rate of the seller, irrespective of the sale price.

In either of the above case, a health and education cess of 4% is charged on top of the tax rate.

In either of the above case, a surcharge is charged on top of the tax rate. This surcharge varies depending on the sale price.

This TDS can be paid via Challan No./ ITNS 281 either, online (https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp) or offline via various bank branches.

Once the TDS has been paid, the buyer needs to file TDS return by way of Form 27Q. This is a quarterly return which needs to be files after the end of every quarter.

NRIs can lower or nullify the TDS by applying for a lower TDS certificate with the income tax department. In this case, the seller should request to the income tax department by filing Form 13.

Based on the information provided by the seller to the income tax department, the department calculated the capital gains arising out of the sale. Is the gains are lower or NIL, the department would provide a certificate to allow TDS to be deducted on the capital gains instead of calculation on the sale price, thereby lowering/nullifying the TDS requirement.

Process of obtaining lower TDS certification

NRI sellers can obtain lower TDS certificate by filing Form 13 with help from a competent CA. If the sellers are more than one, each should file Form 13 seperately. Following information/documents are required:

a) TAN – The buyer(s) should apply for a TAN number. This can be easily obtained online via https://tin.tin.nsdl.com/tan/form49B.html. If there are more than one buyer, each one should apply seperately for TAN.

b) Purchase price/date

c) Sale price/date

d) Circle value of the property

e) Property aquisition related documents

f) MoU/Agreement to sale

Once a lower TDS certificate is obtained, seller should hand it over to the buyer.

Image by mohamed Hassan from Pixabay

Pryank Agrawal is the Founder and CEO of Housewise, a leading property management startup serving customers across 45 countries with operations in 22 Indian cities, including Pune, Bengaluru, Hyderabad, Chennai, Delhi NCR, and Mumbai. An engineering graduate from IIT Roorkee, Pryank brings extensive experience from the software industry. His passion for leveraging technology to solve real estate challenges led him to establish Housewise, simplifying property management for homeowners worldwide. After persistent requests from existing customers to address other challenges faced by Non-Resident Indians, he founded MostlyNRI, a dedicated portal assisting NRIs with taxation and financial asset management in India.