How to make Online Rent Agreement in Greater Noida

Renting a flat in Greater Noida? I have good news for you. You can now create your rent agreement entirely online. No more property agents. No more long queues at government offices.

The Gautam Buddha Nagar administration has introduced an official e-rent portal. You can also use the state-wide Uttar Pradesh IGRSUP website for e-stamping and registration.

This guide will walk you through every single step. We will cover drafting the agreement, paying stamp duty, and the registration process. I will also share the documents you need, the exact costs involved, and some quick local tips to save you time and money.

Let us get started.

Quick Answers (At a Glance)

Before we dive deep, here are quick answers to the most common questions.

| Question | Answer |

|---|---|

| Can I make a rent agreement online in Greater Noida? | Yes, GB Nagar offers an e-rent facility for lease deeds. |

| Do I need to register an 11-month rent agreement? | Not mandatory under the Registration Act; optional for added legal weight. |

| Which portal is used for e-stamping and registration? | IGRSUP (igrsup.gov.in) and SHCIL for e-stamp. |

| What’s the stamp paper value for 11-month rent? | Usually minimal (nominal e-stamp fee); verify on IGRSUP. |

| Can NRIs make agreements remotely? | Yes, using Power of Attorney + e-stamp & e-rent workflow. |

Step-by-Step: Make Your Rent Agreement Online in Greater Noida

Follow these steps carefully. I will break each one down so it is easy to understand.

Step 1 — Choose your agreement duration

This is your first and most important decision. The duration of your rent agreement changes the legal rules.

Most people in Greater Noida choose an 11-month agreement. Why? Because under the Indian Registration Act, any lease agreement for 12 months or more must be registered. An 11-month agreement saves you from that mandatory process. It is a common and perfectly legal practice.

If you plan to rent for a longer period, like two or three years, you must register the agreement. This gives it stronger legal proof in case of any future disputes.

Step 2 — Draft your rent agreement online

You do not need to write the agreement from scratch. That is a headache you can avoid.

You can use a verified online rent agreement maker. Websites like eSahayak, NoBroker, or local services like RegistryWaala have templates. You just fill in your details. They do the rest.

Alternatively, you can download a free, UP-compliant template in Word or PDF format. I recently helped a friend do this. We found a good template online, filled in the blanks, and it was ready in under an hour.

Your rent agreement must include these essential clauses:

- Owner and tenant details: Full names, addresses, and ID numbers.

- Rent, deposit, and due dates: The exact rent amount, the security deposit, and the date it is due each month.

- Maintenance and utilities: Who pays for the electricity, water, and society maintenance?

- Termination clause: How much notice must be given before vacating the property?

- Jurisdiction: This should state that any legal matters will be handled in courts in Gautam Buddha Nagar.

A pro tip is to attach a separate list, or annexure, of all the fixtures, furniture, and appliances in the flat. This prevents disputes later about what was there when you moved in.

Step 3 — Pay stamp duty (e-stamp certificate)

Think of stamp duty as a government tax that makes your document legally valid. You no longer need to buy physical stamp paper.

You can pay for this online. This is done through the Stock Holding Corporation of India Ltd (SHCIL) website or directly via the IGRSUP portal. They will give you an e-stamp certificate with a unique number.

The cost depends on your agreement duration.

- For an 11-month lease, the stamp duty is usually a small, nominal fee. It is often around one or two hundred rupees.

- For leases longer than 12 months, the stamp duty is a percentage of the annual rent plus the security deposit. This can be around 2% to 4%.

The exact rate can change. Always check the fee calculator on the official IGRSUP website before you pay.

Step 4 — Optional: Use GB Nagar e-Rent Portal

This is a special facility for Greater Noida residents. After you have your drafted agreement and e-stamp, you can submit the details on the district’s own e-rent portal.

It creates an official record with the local administration. It adds an extra layer of authenticity to your document. It is like telling the local government, “Hey, we have a rent agreement here,” and they make a note of it.

Step 5 — Register (only for >12-month leases)

Remember step one? If your lease is for 12 months or more, you must do this step. Registration is mandatory.

You use the IGRSUP website again. You go to “Apply for Property Registration” and book an appointment at the nearest Sub-Registrar Office (SRO) in Greater Noida.

You must go there in person with all the required documents.

You need to bring:

- The original e-stamped agreement.

- ID proofs of the owner, the tenant, and two witnesses.

- A property tax receipt as proof of ownership.

- Passport-sized photographs.

- If the owner cannot come, a Power of Attorney document.

The registration office will verify all the documents. They will then officially register the agreement. This process involves an additional registration fee, which is usually about 1% to 2% of the total value.

Step 6 — Verify and keep records

You are almost done. Now, you must be organized.

Save PDF copies of everything. This includes the final signed agreement and the e-stamp certificate. Keep a physical signed copy in a safe place.

You can also verify your e-stamp online to confirm it is real. Use the SHCIL e-Stamp Verification tool on their website. You just enter your certificate number and the issue date. It will show you the genuine certificate details. It is a good habit to check this.

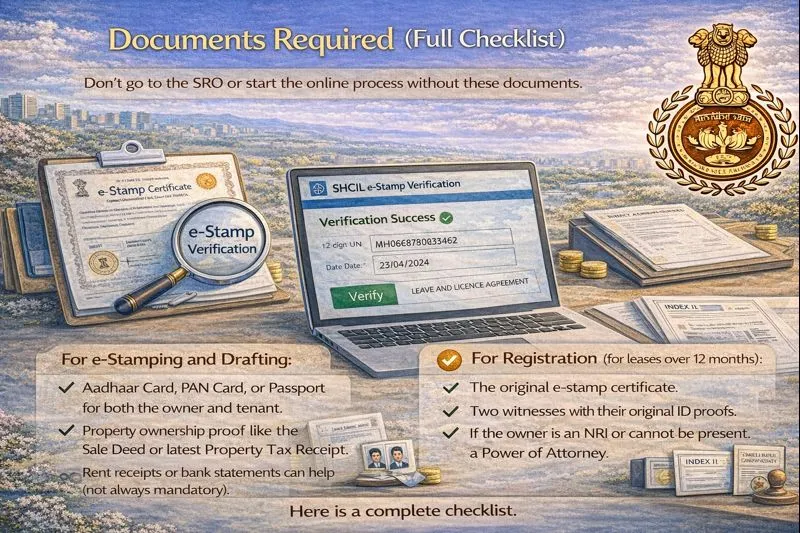

Documents Required (Full Checklist)

Do not go to the SRO or start the online process without these documents. It will only waste your time. Here is a complete checklist.

For e-Stamping and Drafting:

- Aadhaar Card, PAN Card, or Passport for both the owner and tenant.

- Property ownership proof like the Sale Deed or the latest Property Tax Receipt.

- Passport-sized photographs of the owner, tenant, and witnesses.

- The draft agreement you prepared.

- Previous rent receipts or a bank statement can be helpful but are not always mandatory.

For Registration (for leases over 12 months):

- The original e-stamp certificate.

- Two witnesses with their original ID proofs.

- If the owner is an NRI or cannot be present, a Power of Attorney.

- An Index II document or a circle rate certificate may be required in some cases.

Stamp Duty and Registration Fees in Greater Noida (2025)

I know the costs can be confusing. This table breaks it down simply. Please remember, these are approximate figures. Always check the official IGRSUP portal for the most current rates.

| Lease Duration | Stamp Duty (approx.) | Registration Fee | Registration Needed |

|---|---|---|---|

| Up to 11 months | Nominal (Rs. 100–200 typical) | None | No |

| 12–35 months | ~2–4% of annual rent + deposit | 1–2% extra | Yes |

| >35 months | As per total lease value | 1–2% extra | Yes |

A quick note. The stamp duty and registration charges are often shared between the tenant and the landlord. You should clearly agree on who pays what and write it into your rent agreement.

Common Clauses to Include in Your Rent Agreement

A strong agreement is a detailed one. Think of it as a rulebook for your tenancy. It prevents “he said, she said” arguments later.

Make sure your agreement clearly mentions:

- Rent amount, due date, and payment method: Is it cash, bank transfer, or cheque?

- Security deposit and refund terms: When will you get the deposit back after vacating? What deductions can be made?

- Repair and maintenance clauses: Is the tenant responsible for fixing a leaking tap? Who pays for a broken geyser?

- Lock-in period: This is a minimum period you must stay. Leaving before this means you lose your deposit.

- Notice period: Typically 30 to 90 days. This is how much advance notice you must give before leaving.

- Subletting rules: Is the tenant allowed to rent the flat to someone else? Usually, the answer is no without the owner’s permission.

- Dispute resolution and jurisdiction clause: This states that any legal issues will be handled in courts in Gautam Buddha Nagar.

NRI and Power of Attorney (POA) Process

What if the property owner lives abroad? I have seen many NRIs struggle with this. The process is straightforward if you know the steps.

An NRI can authorize a relative or friend in India to sign the rent agreement on their behalf. This is done through a Power of Attorney (POA).

Here is how it works:

- The NRI creates a Power of Attorney document. This must be attested by the Indian Consulate in their country or a local notary.

- The person in India, the attorney, submits this POA along with copies of the NRI’s passport at the SRO during registration.

- The entire process uses e-stamp, the e-rent portal, and the POA. This allows for a smooth and remote execution of the lease.

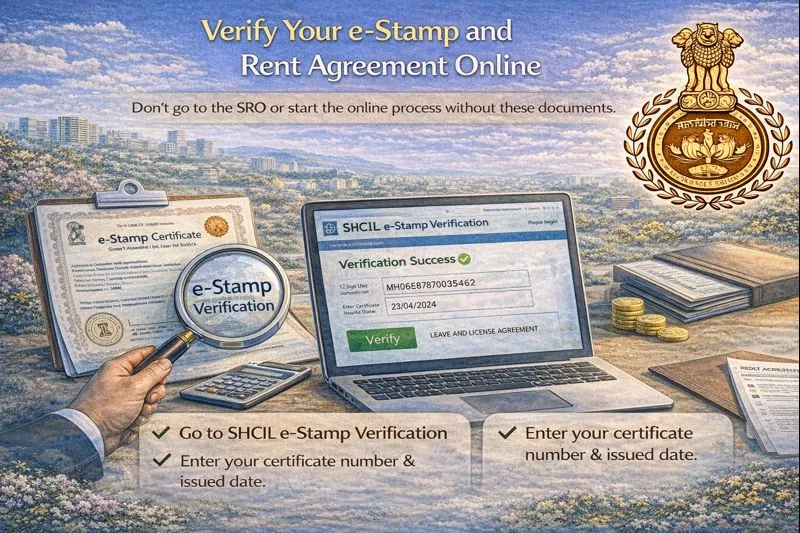

Verify Your e-Stamp and Rent Agreement Online

You bought a product online. You would check the tracking number, right? The same logic applies to your e-stamp.

Verifying your e-stamp certificate is crucial. It confirms the government has your payment on record.

- Go to the SHCIL e-Stamp Verification website.

- Enter your e-stamp certificate number and the date it was issued.

- The website will show you the genuine certificate details. It will match the information from your agreement.

This simple check takes two minutes. It gives you peace of mind.

Sub-Registrar Offices (SRO) in Greater Noida

If you need to register your agreement, you will likely visit one of these offices. It is good to know where they are.

| SRO Office | Location | Contact |

|---|---|---|

| Sub-Registrar 1 | Surajpur, GB Nagar | gbnagar.nic.in |

| Sub-Registrar 2 | Dadri, GB Nagar | gbnagar.nic.in |

| Sub-Registrar 3 | Jewar | gbnagar.nic.in |

Common Mistakes to Avoid

I have seen people make simple errors that cause big problems. Let us learn from their mistakes.

- Using unstamped agreements: An agreement without a stamp duty payment is not legally valid. It cannot be used as evidence in court.

- Signing without witnesses: Both the landlord and tenant must sign the agreement in the presence of two witnesses. Their signatures and details are essential.

- Ignoring property proof: The tenant should always ask to see the landlord’s ownership document. This ensures you are dealing with the real owner.

- Not registering long leases: If your lease is for 12 months or more and you do not register it, the agreement has little legal value. Do not skip this.

- Using outdated templates: Property laws get updated. Make sure your rent agreement template is recent and complies with the latest UP tenancy laws.

Frequently Asked Questions (FAQs)

1. Is an online rent agreement valid in Greater Noida?

Yes, it is completely valid. As long as the agreement is properly e-stamped and signed by both the landlord and the tenant, it is a legal document. If the rental period is for more than 12 months, you must also get it registered at the Sub-Registrar Office.

2. How can I check my rent agreement details online?

You can check the details through two main portals. Use the SHCIL e-stamp verification tool to confirm your e-stamp certificate is genuine. You can also use the IGRSUP portal to track the status if you have applied for registration.

3. What is the stamp duty for an 11-month rent agreement?

The stamp duty for an 11-month agreement is usually a small, nominal fee. It is not a percentage. You can typically expect to pay between one and two hundred rupees for the e-stamp certificate. You should always check the IGRSUP website for the exact fixed rate.

4. Can I create a rent agreement without visiting a government office?

Yes, you often can. For a standard 11-month agreement, the entire process can be completed online from your home. You can use digital platforms for drafting, e-stamping, and even signing. Only leases longer than 12 months require a physical visit to the Sub-Registrar Office for registration.

5. Who pays the stamp duty and registration charges?

The law does not clearly specify who must pay. This is something for the landlord and tenant to decide together. In most cases, the cost is shared equally between both parties. The most important thing is to agree on this beforehand and clearly write who will pay for what in the rent agreement itself.

6. Do both the landlord and tenant need to be present for registration?

For the registration of a lease longer than 12 months, yes, physical presence is generally required. Both parties must go to the Sub-Registrar Office (SRO) with two witnesses and their original ID proofs. If the landlord cannot be present, they can appoint a representative through a Power of Attorney (POA).

7. What is the difference between e-stamping and registration?

Think of it like this: e-stamping is paying a government tax to make the document legally valid. It is like buying a virtual stamp paper. Registration is the process of officially recording the document with the government, which gives it much stronger legal evidence. An 11-month agreement only needs e-stamping. A longer lease needs both.

8. What happens if I don’t register a lease for 2 years?

If you do not register a lease agreement that is for 12 months or more, it becomes invalid as a legal document. You cannot use it as evidence in a court of law if a dispute arises with your landlord or tenant. It is a crucial step for your legal protection.

Also Read: How to make Online Rent Agreement in Ghaziabad

Also Read: How to make Online Rent Agreement in Noida

Also Read: How to make Online Rent Agreement in Gurugram

Pryank Agrawal is the Founder and CEO of Housewise, a leading property management startup serving customers across 45 countries with operations in 22 Indian cities, including Pune, Bengaluru, Hyderabad, Chennai, Delhi NCR, and Mumbai. An engineering graduate from IIT Roorkee, Pryank brings extensive experience from the software industry. His passion for leveraging technology to solve real estate challenges led him to establish Housewise, simplifying property management for homeowners worldwide. After persistent requests from existing customers to address other challenges faced by Non-Resident Indians, he founded MostlyNRI, a dedicated portal assisting NRIs with taxation and financial asset management in India.