Stamp Duty & Registration Charges (2025 Update)

Buying a property is a huge milestone. You save for years. You find the perfect home. You negotiate the price. You think you have the final number figured out.

And then… you hear about stamp duty and registration charges. Your heart drops. The pressure is on.

These costs can add a significant amount to your final bill. But what are they exactly? Why do they vary so much? And how can you navigate the latest rules for 2025 without overpaying?

This guide cuts through the confusion. We provide a clear, state-wise breakdown of stamp duty and registration charges for 2025. We explain how to calculate your costs, claim rebates, and use the new digital processes. Our goal is to make you feel informed and confident, not overwhelmed.

Let us demystify these costs together.

What Are Stamp Duty & Registration Charges?

Think of buying a property like adopting a pet. The agreed price with the seller is like the adoption fee. But to make it officially yours, you need a license and microchip from the city. That is what stamp duty and registration are for your property.

Stamp duty is a state government tax. It is a charge for the legal recognition of your property transaction. It makes your sale deed or ownership document a legally enforceable piece of evidence in court. The rate is a percentage of your property’s value, and it changes from state to state.

Registration charge is a separate fee you pay to have your document recorded in the official records of the Sub-Registrar of Assurances. This public recording establishes you as the legal owner. It prevents fraud and makes your ownership claim ironclad.

Both fees are mandatory. You cannot become the legal owner of any property in India without paying them. They directly impact your final cost of ownership. Ignoring them is not an option. Understanding them is your superpower.

India-Wide Snapshot of 2025 Rates

Rates are not uniform across India. Each state government sets its own stamp duty and registration charges based on its revenue needs and policy goals. This means the cost for an identical property can be very different in Mumbai versus Bangalore.

This table provides a clear snapshot of the latest 2025 rates for major states. Use it as a starting point for your calculations.

| State/UT | Stamp Duty 2025 | Registration Fee 2025 | Special Rebates & Notes |

|---|---|---|---|

| Delhi (Male) | 6% urban, 5.5% NDMC, 3% cantonment | 1% | Women: 4%, Joint (man+woman): 5% |

| Maharashtra | 5–7% (Mumbai ~6%) | 1% (capped at ₹30,000) | Women receive a 1% concession on the duty rate. |

| Karnataka | 2–5% (tiered by property value) | 1% | No specific gender-based rebates. |

| Gujarat | 4.9% | 1% | Women buyers enjoy a reduced stamp duty rate of ~3.9%. |

| West Bengal | 6–7% | 1% | Rates can vary between urban and rural areas. |

| Uttar Pradesh (Noida) | 6–7% | 1% | Women get a 1% rebate on properties ≤ ₹1 crore. Partition deed flat ₹5,000. |

| Andhra Pradesh | 5% | 1% | — |

| Madhya Pradesh | 7.5% | 1% | Strict penalties for underpayment: 1% penalty + 1% interest per month. |

| Haryana | 7% urban, 5% rural | 1% | Women buyers are charged a lower rate of 5%. |

| Other States | Typically between 2% and 8% | ~1% | Rebates for women, seniors, or first-time buyers are common. |

Sources: Godrej Capital, ClearTax, LegalEye, 99acres

As you can see, states like Madhya Pradesh and Haryana have some of the highest rates. Others, like Gujarat and Andhra Pradesh, are more moderate. The most important takeaway is the widespread availability of rebates for women buyers. This is a strategic financial incentive many families use to reduce the overall cost.

How to Calculate Stamp Duty — A Practical Example

The math is simple. The challenge is knowing which values to plug into the equation. You do not just calculate duty on the sale price you negotiated with the builder or seller.

You calculate it on the circle rate or the sale price, whichever is higher.

The circle rate is the minimum value set by the state government for an area. It is the legal benchmark for property transactions. If you buy an apartment for ₹80 lakh but the government circle rate for that area is ₹1 crore, you will pay stamp duty on ₹1 crore. This rule prevents people from underreporting property values to avoid tax.

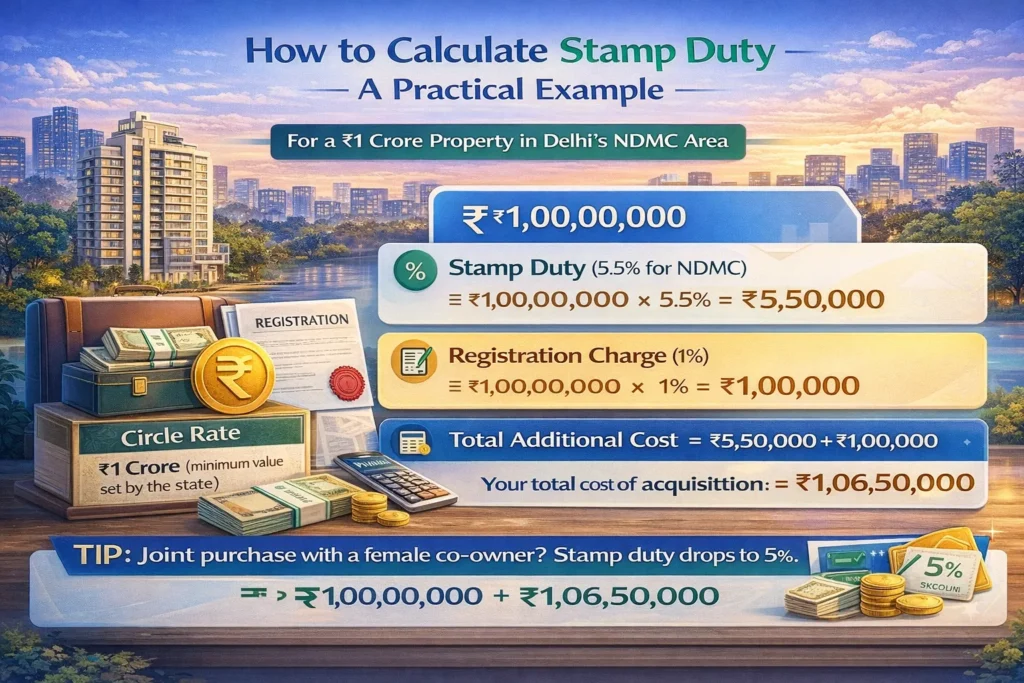

Let us walk through a real example for a property in Delhi’s NDMC area.

Assume you are a male buyer. You negotiated a great deal and bought a property for ₹1,00,00,000 (1 crore). The circle rate for that locality is also ₹1 crore.

- Property Value: ₹1,00,00,000

- Stamp Duty (5.5% for NDMC): ₹1,00,00,000 x 5.5% = ₹5,50,000

- Registration Charge (1%): ₹1,00,00,000 x 1% = ₹1,00,000

- Total Additional Cost: ₹5,50,000 + ₹1,00,000 = ₹6,50,000

Your total cost of acquisition is not ₹1 crore. It is ₹1,06,50,000.

If this were a joint purchase with a female co-owner, your stamp duty would drop to 5%. That would save you ₹50,000 immediately. This is why checking for rebates is so crucial.

Digital Processes and e-Stamping in 2025

Gone are the days of long queues and messy paperwork. The Indian property registration system has gone digital. The Registration Bill 2025 has made online processes the new standard. This is great news for everyone, especially NRIs.

The entire process is now more streamlined and transparent.

e-Stamping is the first step. You can pay your stamp duty online through the SHCIL (Stock Holding Corporation of India Ltd) portal or your state’s specific e-GRAS portal. You get a secure, unique certificate (a PDF) that serves as proof of payment. This eliminates the risk of fake physical stamp papers.

Online Registration follows. The 2025 reforms emphasize digital submission of documents. This includes PAN and Aadhaar verification for all parties involved. The goal is to make the process faster and more secure. The government has mandated that all registrations should be completed within 7 working days from application.

There are penalties for ignoring the digital shift. For example, starting July 2025, Uttar Pradesh will impose a ₹5,000 fine on rental agreements that are not registered online. Adopting the digital process is no longer just convenient. It is essential to avoid unnecessary fines.

Key 2025 Updates, Rebates, and Reforms

The rules are not static. States regularly tweak them to promote certain buyer categories or simplify transactions. Keeping up with these changes can save you a lot of money. Here are the most significant updates for 2025.

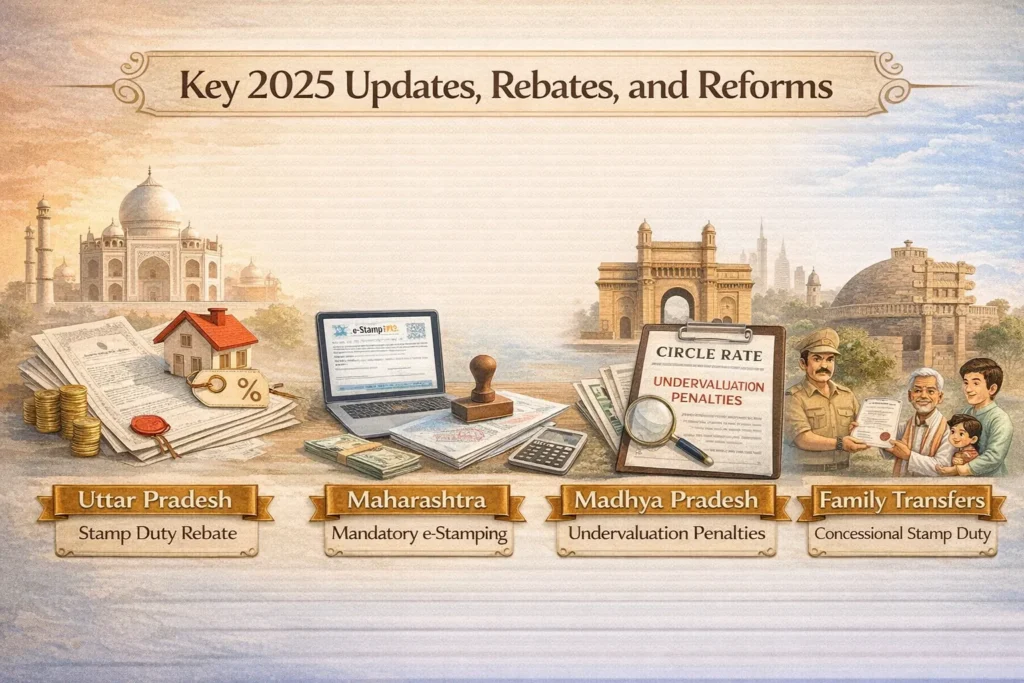

Uttar Pradesh has introduced several consumer-friendly reforms. There is a 1% rebate on stamp duty for women buyers on properties valued up to ₹1 crore. Registering a partition deed now costs a flat fee of ₹5,000, a massive reduction from it being a percentage of the property value. These rebates have also been extended to ex-servicemen and persons with disabilities.

Maharashtra has made e-stamping mandatory for certain documents, including power of attorney and mortgages. The duty rates for these instruments have also been revised upwards. This move aims to curb fraud and bring more transactions into the formal system.

Madhya Pradesh has a stern warning for buyers. The state is strictly enforcing rules against undervaluation. If you are caught paying duty on a value lower than the circle rate, you will face a penalty of 1% per month on the deficit amount, plus 1% interest.

Family Transfers remain a area with potential savings. Most states offer concessional stamp duty rates for transactions between family members. This includes gift deeds, inheritance, and relinquishment deeds. The rates are often a small fraction of the standard duty, making it a tax-efficient way to transfer property within a family.

Your Step-by-Step Guide to Paying Stamp Duty Online

The process might seem daunting. But broken down into steps, it is quite manageable. Here is your action plan for a smooth and compliant transaction.

- Determine the Correct Value: This is the most critical step. Check the circle rate for your property’s location on your state’s land revenue website. Compare it with your final sale price. Your duty will be calculated on the higher of the two figures.

- Look Up Your State’s Rates: Refer to the table earlier in this article or visit your state’s official Registration Department portal. Confirm the exact stamp duty percentage and registration fee. Check if you qualify for any rebates.

- Calculate Your Final Cost: Use the state’s official online calculator or a reliable third-party tool. Do the math twice to be sure. Know the exact amount you need to pay before you start the payment process.

- Make the e-Payment: Visit the SHCIL website or your state’s e-stamping portal. Fill in the required details about the property, buyer, and seller. Pay the calculated stamp duty amount online via net banking, UPI, or debit/credit card. Download and print the e-stamp certificate.

- Register the Sale Deed: Book an appointment at the local Sub-Registrar Office. Bring all parties involved, along with two witnesses. Carry all original documents, including your e-stamp certificate, identity proofs, property papers, and passport-sized photographs. The officials will verify the documents and process the registration.

- Claim Your Rebates: If you are eligible for a rebate, make sure you claim it during the registration process. Provide the necessary documents to prove your eligibility. For example, a woman buyer must have her name on the sale deed to claim the lower duty rate.

Frequently Asked Questions

Do women really get a rebate on stamp duty?

Yes, absolutely. Many states offer incentives to encourage property ownership among women. The rebate is not uniform. It could be a 1% concession like in Maharashtra and UP, or a full 2% reduction like in Delhi. Always check your specific state’s policy.

Can NRIs pay stamp duty and registration charges online?

Yes, the digital process is a major benefit for NRIs. They can pay stamp duty via e-stamping portals from abroad. However, for the final registration, the physical presence of the NRI buyer or a legally authorized representative holding a valid Power of Attorney is usually mandatory. NRIs must also remember to comply with TDS rules on property purchases.

Are gift deeds taxed differently than sale deeds?

Yes, and this is a key way to save money. Most states charge a significantly lower stamp duty on gift deeds executed between close family members. The rate might be a small percentage or a nominal fixed amount. However, it is crucial to prove the familial relationship to avail of this concession.

Can I claim the stamp duty paid in my income tax return?

Yes, but with conditions. The stamp duty you pay is considered part of the cost of acquisition. You can claim it under Section 80C of the Income Tax Act, but only if you are using the old tax regime. The deduction is subject to the overall Section 80C limit of ₹1.5 lakh per financial year. You cannot claim this deduction if you have chosen the new tax regime.

We hope this detailed guide empowers you to navigate the financial aspects of your property purchase with clarity. The rules are specific, but they are not insurmountable. Knowing them is the first step to saving money and securing your investment.

Pryank Agrawal is the Founder and CEO of Housewise, a leading property management startup serving customers across 45 countries with operations in 22 Indian cities, including Pune, Bengaluru, Hyderabad, Chennai, Delhi NCR, and Mumbai. An engineering graduate from IIT Roorkee, Pryank brings extensive experience from the software industry. His passion for leveraging technology to solve real estate challenges led him to establish Housewise, simplifying property management for homeowners worldwide. After persistent requests from existing customers to address other challenges faced by Non-Resident Indians, he founded MostlyNRI, a dedicated portal assisting NRIs with taxation and financial asset management in India.