Refund Process for Stamp Duty on Cancelled Agreements

Picture this. You’ve just signed a property deal. Paid the hefty stamp duty. Registered the sale deed. But then… things fall apart. Maybe the seller can’t deliver the property. Maybe your job transfers you to another city. Or maybe the property’s title isn’t clear.

Now you’re left wondering: Is all that money you paid for stamp duty gone forever?

The good news: you can often get a refund. The bad news: the rules aren’t the same everywhere. And the process can be slow if you don’t do it right.

In this guide, we’ll break down the refund process for stamp duty on cancelled agreements step by step. You’ll learn when you’re eligible, what documents you need, how long it takes, and the common mistakes people make that delay refunds.

By the end, you’ll know exactly what to do if your deal falls through.

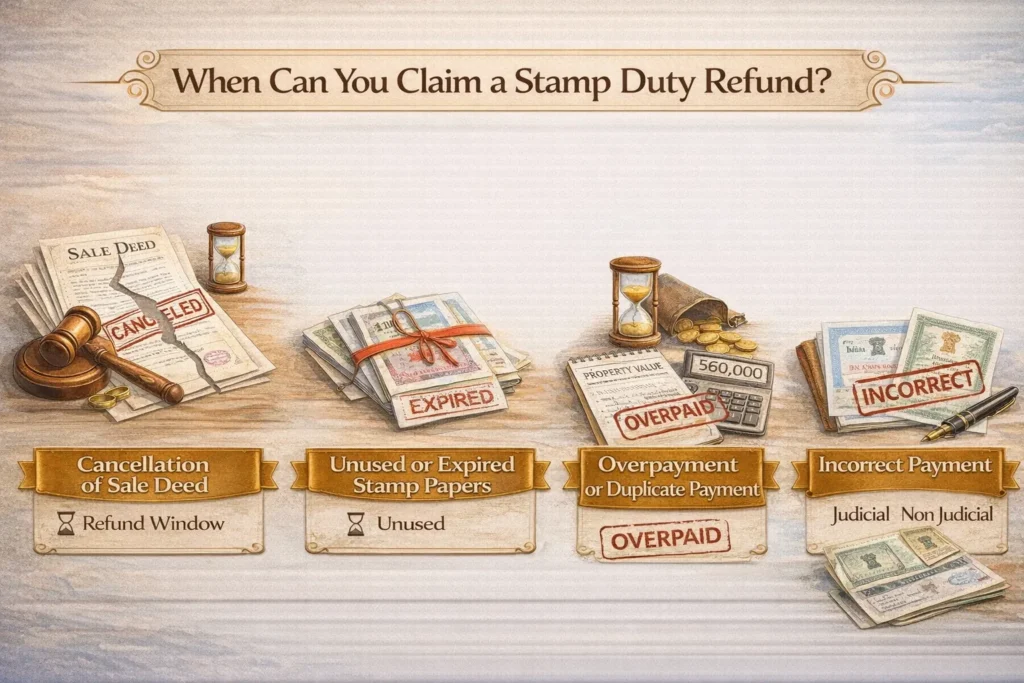

When Can You Claim a Stamp Duty Refund?

Stamp duty is like an entry fee for property ownership. Once you’ve paid it, the government records you as the rightful buyer. But what if the game never starts? What if the deal collapses?

Here are the main situations where you can claim a refund:

- Cancellation of Sale Deed

If you and the seller cancel the registered deed within the permitted timeline, you can apply for a refund. For example, Maharashtra allows claims up to two years. In most other states, the window is shorter — 6 months to 1 year.

- Unused or Expired Stamp Papers

Bought stamp papers for a deal that never happened? As long as they’re unused and within the validity period (usually 6 months), you can return them for a refund. Expired papers are like expired train tickets — useless.

- Overpayment or Duplicate Payment

Maybe you miscalculated property value. Or paid the duty twice by mistake. In such cases, you can file for reimbursement.

- Incorrect Payment

Let’s say you used judicial stamp paper instead of non-judicial, or vice versa. That’s an error, but you don’t have to lose the money if you apply correctly.

Think of stamp duty refunds like returning a product you didn’t use. The shopkeeper won’t always give you 100% back, but you’ll get most of it if you follow their return policy.

Eligibility Criteria & Time Limits by State

This is where it gets tricky. The Indian Stamp Act sets the broad rules, but each state has its own fine print.

Here’s a snapshot of how some major states handle refund timelines and deductions:

| State | Refund Window | Deduction | Special Notes |

|---|---|---|---|

| Maharashtra | Up to 6 months for cancellation, and up to 2 years in some cases | 10% of duty paid | Refunds can be applied online via IGR portal |

| Delhi | Within 6 months of deed cancellation | 10% admin fee | Refund must be filed at Sub-Registrar’s office |

| Karnataka | Within 1 year | 10% or ₹500 (whichever is higher) | Requires notarized cancellation deed |

| Tamil Nadu | Within 6 months | Flat ₹1000 deduction | Cancellation deed must be registered |

| Gujarat | Within 6 months | 10% deduction | Refund only if no litigation is pending |

| Uttar Pradesh | Within 1 year | 10% of duty | Requires collector’s approval |

Note: Always double-check the latest state notifications. Rules change, and the refund window is non-negotiable.

Step-by-Step Refund Process

Let’s cut through the legal fog. Here’s the refund process simplified:

- Check Eligibility

Confirm your reason qualifies — cancellation, unused paper, overpayment, or error.

- Prepare Documents

Collect the original deed, cancellation agreement, proof of stamp duty payment, ID proof, and bank details. We’ll detail this in the next section.

- Fill Application Form

Each state has its own form. Some states like Maharashtra even allow online submission

- Submit Application

File your application with the Sub-Registrar or Collector’s office. Attach all required papers.

- Verification Stage

Officials verify if the deed was indeed cancelled and if documents are complete. This step often causes delays, so accuracy matters.

- Approval & Refund

Once cleared, the refund is processed. Funds are usually transferred directly to your bank account.

Timeline?

- Best case: 15–30 days (as seen in some state portals).

- Average case: 2–3 months.

- Worst case: up to 6 months if verification drags or documents are disputed.

It’s like applying for an insurance claim. Smooth if all documents are correct. Painful if you miss even one.

Required Documents for Claim

Documentation is where most people stumble. Miss one paper, and your file gathers dust.

Here’s the usual checklist:

- Original Stamp Paper (unused or attached to cancelled deed)

- Registered Cancellation Deed (mandatory in most states)

- Original Sale Deed details / registration receipt

- Proof of Stamp Duty Payment (receipt or challan)

- Refund Application Form (state-specific)

- Affidavit explaining reason for refund request

- ID Proof (Aadhar, Passport, Voter ID)

- Bank Account Details (cancelled cheque or bank statement)

- Supporting Documents like death certificate (if cancellation due to death), transfer orders (job relocation), or bankruptcy order

Pro tip: Attach a covering letter summarizing your case. It helps officials see everything at a glance.

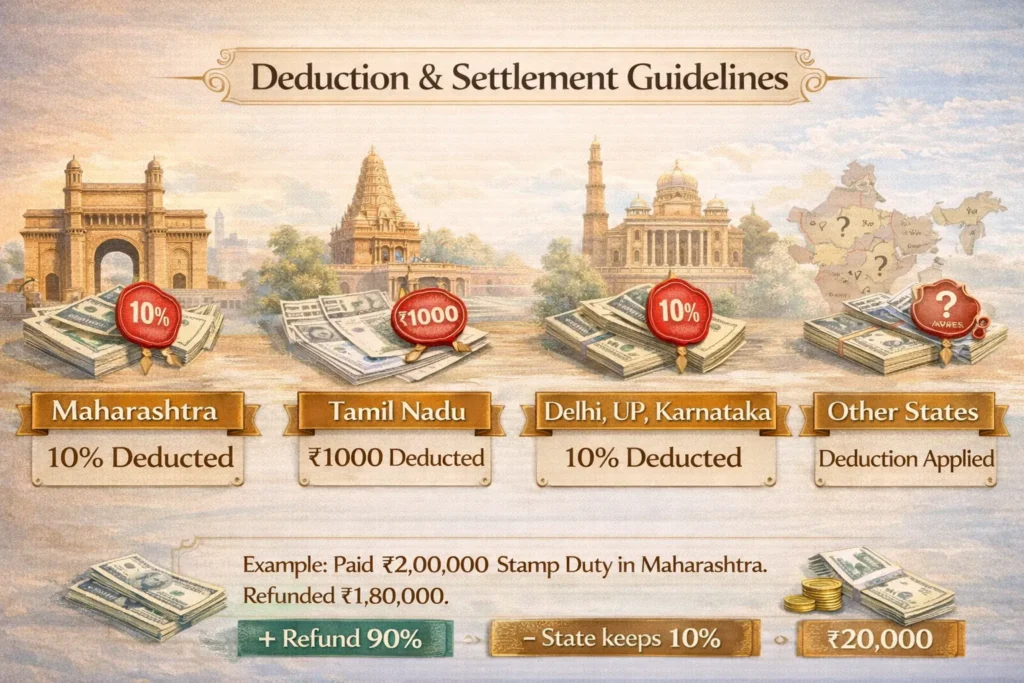

Deduction & Settlement Guidelines

Refunds are rarely 100%. States usually keep a slice for administrative costs.

- Maharashtra: 10% of stamp duty amount is deducted.

- Tamil Nadu: Flat deduction of ₹1000.

- Delhi, UP, Karnataka: 10% of the paid duty.

- Other States: Varies, but always some deduction unless it’s a clear overpayment.

Example:

If you paid ₹2,00,000 as stamp duty in Maharashtra and cancelled within 6 months, you’ll get back ₹1,80,000. The state keeps ₹20,000.

Think of it like cancelling a flight ticket. Airlines refund most of it, but you lose the service fee.

Common Pitfalls & How to Avoid Them

- Missing the Deadline

Apply late, even by one day, and your refund request is rejected.

- Incomplete Documentation

Forgetting a single attachment like an affidavit can reset your file.

- Not Registering Cancellation

A cancellation deed must usually be registered. Skipping this step makes your refund claim invalid.

- Not Following Up

Refunds don’t move automatically. Regular visits or online status checks keep your application alive.

- Assuming Rules Are the Same Everywhere

Each state has its own quirks. Maharashtra’s online system isn’t the same as Delhi’s offline one.

FAQs

Q1. Can stamp duty be refunded after agreement cancellation?

Yes, but only if you apply within the state’s deadline. Usually 6 months, sometimes up to 2 years.

Q2. How much of the stamp duty is refunded?

Most states deduct 10% as administrative fees. A few charge a flat fee.

Q3. How long does it take?

Anywhere from 15 days to 6 months, depending on the state and completeness of your file.

Q4. Can NRIs apply for stamp duty refund remotely?

Yes. Through a Power of Attorney (POA) or via online portals in states like Maharashtra. But notarization or embassy attestation may be required.

Q5. What about e-stamp papers?

Refunds for unused e-stamp papers must be applied at the same issuing center or via the state’s online portal.

Conclusion

Stamp duty refunds can feel like navigating a maze. Each state has its own doors, keys, and traps. But the rules are clear once you map them out.

Remember: act quickly, document carefully, and follow up regularly. That way, you don’t lose money that rightfully belongs to you.

I’ve seen friends recover lakhs of rupees simply because they applied on time with the right paperwork. And I’ve seen others lose it all because they missed a deadline.

If your deal falls through, don’t just walk away. File your refund claim. A little effort now could save you a big financial headache later.

Pryank Agrawal is the Founder and CEO of Housewise, a leading property management startup serving customers across 45 countries with operations in 22 Indian cities, including Pune, Bengaluru, Hyderabad, Chennai, Delhi NCR, and Mumbai. An engineering graduate from IIT Roorkee, Pryank brings extensive experience from the software industry. His passion for leveraging technology to solve real estate challenges led him to establish Housewise, simplifying property management for homeowners worldwide. After persistent requests from existing customers to address other challenges faced by Non-Resident Indians, he founded MostlyNRI, a dedicated portal assisting NRIs with taxation and financial asset management in India.