How to make Online Rent Agreement in Panchkula

Creating a rent agreement in Panchkula is now simple. You can draft it online, pay stamp duty through Haryana’s e-stamp system, and even e-sign it from home. This guide explains the full process, from drafting to registration, including required documents, charges, and legal validity.

I recently helped my cousin rent out his flat in Sector 20, Panchkula. He was dreading the paperwork. The thought of running around between stamp vendors and registrar offices? Not fun. But here’s the thing. The entire process took us three days. We did everything online. No running around. No standing in queues. And that’s exactly what I’m going to show you today.

Why Choose an Online Rent Agreement in Panchkula?

Let me be honest with you. The old way of creating rent agreements was a headache. You’d have to find a lawyer, get the right stamp paper, arrange meetings with witnesses, and then physically go to offices.

Not anymore. Online rent agreements have changed the game completely. And I’m not just saying that because it sounds good. There are real, practical reasons why this method works better.

First, you don’t need to step out of your house. You can draft the agreement, pay the stamp duty, and sign everything digitally. Your tenant could be sitting in Delhi while you’re in Panchkula. Doesn’t matter.

Second, it saves you actual time. What used to take 7 to 10 days now takes 1 to 3 days max. That’s huge if you’re trying to move in quickly or if you’re coordinating with a tenant who has a tight schedule.

Third, and this is important, it’s legally valid. People often worry about this. “Is an online agreement real?” Yes. Absolutely. It’s recognized under the Haryana Urban (Control of Rent and Eviction) Act, 1973. Courts accept it. Banks accept it for loans. Your company accepts it for HRA claims. The GST department accepts it.

Fourth, it ensures accuracy. When you use verified platforms like eSahayak or NoBroker, you’re using templates that lawyers have reviewed. You’re not missing crucial clauses. You’re not making basic mistakes that could cost you later.

Let me give you a quick comparison:

Offline vs Online Process

| Aspect | Offline Method | Online Method |

|---|---|---|

| Time Required | 7-10 days | 1-3 days |

| Physical Visits | Multiple (stamp vendor, notary, SRO) | Zero or one |

| Cost | ₹1,500-₹3,000 | ₹1,000-₹2,000 |

| Convenience | Low | High |

| Document Safety | Risk of loss/damage | Digital backup available |

The numbers speak for themselves.

Hundreds of landlords and tenants in Panchkula are already doing this. And once you see how simple it is, you’ll wonder why you didn’t do it sooner.

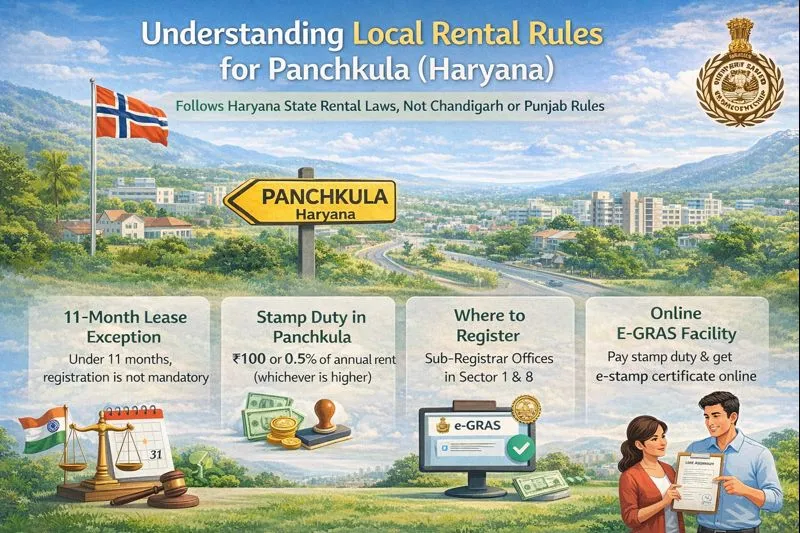

Understanding Local Rules for Panchkula (Haryana)

Now, before we dive into the process, you need to know something important about Panchkula’s legal setup. Panchkula is in Haryana. Not Chandigarh. Not Punjab. This matters because rental laws vary by state. I’ve seen people get confused about this. They think because Panchkula is so close to Chandigarh, the same rules apply. They don’t.

Panchkula follows Haryana state rental laws. Specifically, the Haryana Urban (Control of Rent and Eviction) Act, 1973 governs how rent agreements work here.

Here’s what you need to know:

The 11-month lease exception. This is probably the most important thing. If your lease is for 11 months or less, you don’t need to register it. You still need proper stamp paper. You still need signatures and witnesses. But you can skip the registration step at the Sub-Registrar Office.

Why 11 months? Because under Indian law, any lease longer than 11 months must be registered. Registration means more paperwork, more fees, and a trip to the government office. Most landlords and tenants prefer to avoid this, so they stick to 11-month agreements and renew them later if needed.

Stamp duty matters. In Panchkula, you need to pay stamp duty of either ₹100 or 0.5% of your total annual rent, whichever amount is higher.

Let me break this down with an example. Say your monthly rent is ₹15,000. Your annual rent is ₹1,80,000. Half a percent of that is ₹900. Since ₹900 is more than ₹100, you’d pay ₹900 as stamp duty.

But if your rent is ₹10,000 per month (₹1,20,000 annually), 0.5% would be ₹600. You’d still pay ₹600 because it’s higher than the ₹100 minimum.

Make sense?

Where to register (if needed). If your agreement is longer than 11 months, you’ll need to register it at the Sub-Registrar Office in Panchkula. There are offices in Sector 1 and Sector 8. You can also do this through online portals now, though you might still need one visit.

The e-GRAS system. Haryana has an online system called e-GRAS (Electronic Government Receipt Accounting System). This is where you pay your stamp duty online and get your e-stamp certificate. It’s actually pretty straightforward once you know how to use it.

The thing is, these rules protect both landlords and tenants. They make sure there’s a clear, legal record of your agreement. They prevent disputes. They give you something solid to fall back on if things go wrong.

And honestly? Once you understand them, they’re not complicated at all.

Step-by-Step Guide to Making an Online Rent Agreement in Panchkula

Alright. Let’s get to the actual process. I’m going to walk you through this exactly as I did it with my cousin.

Step 1: Draft the Agreement

This is where everything starts. You need a proper written agreement that covers all the important points. Don’t just download some random template from Google. I mean, you could, but you’d be taking a risk. You want a template that’s specific to Haryana laws. One that includes all the clauses you actually need. What should your agreement include?

The basics: names and addresses of the landlord and tenant. The property address, obviously. The rent amount and when it’s due (usually the 1st or 5th of each month). The security deposit amount. The duration: start date and end date. Most people do 11 months, as we discussed.

Maintenance details: who pays for what? Usually, tenants pay for electricity and water. Landlords handle major repairs. But you need to spell this out clearly. Notice period: how much notice does either party need to give before ending the agreement? Usually it’s 1 to 3 months. Clauses about pets, subletting, modifications to the property. These matter. I’ve seen friendships ruined because someone painted walls without permission. Signature sections for landlord, tenant, and two witnesses.

Where do you get a good template? Platforms like eSahayak and AgreementKart offer Haryana-specific drafts. They cost around ₹500 to ₹1,000, but they’re reviewed by lawyers. Worth it for the peace of mind. You can also find Word or PDF templates online, but make sure they’re updated for and include recent legal requirements. Once you have your draft, read it carefully. Both landlord and tenant should review it. Make changes if needed. Add specific clauses if you have special requirements.

This step usually takes a few hours. Don’t rush it.

Step 2: Calculate and Pay Stamp Duty

Now comes the payment part. Remember the calculation we talked about earlier? ₹100 or 0.5% of annual rent, whichever is higher. Let’s say your monthly rent is ₹20,000. Annual rent is ₹2,40,000. Half a percent is ₹1,200. So you’d pay ₹1,200 in stamp duty. Here’s how to pay it online:

Go to the Haryana e-GRAS portal or the SHCIL (Stock Holding Corporation of India Limited) website. Both handle e-stamping for Haryana. Create an account if you don’t have one. You’ll need basic details like name, address, email, and phone number. Select the type of document. In this case, it’s a rental agreement.

Enter the details. Property address, rent amount, duration, parties’ names.

The system will calculate the stamp duty for you. Double-check that it’s correct. Make the payment. You can use net banking, debit card, or credit card. Once payment goes through, you’ll get an e-stamp certificate. This is a PDF with a unique number. Download it immediately. Save multiple copies.

This certificate is your proof that you’ve paid stamp duty. It’s legally valid. Courts recognize it. It’s the same as the old physical stamp paper, just digital. The whole process takes maybe 30 minutes if you have all your information ready.

Pro tip: Keep a screenshot of the payment confirmation page. Sometimes downloads fail, and you’ll want backup proof.

Step 3: Sign and Execute

This is where your agreement becomes official. Both the landlord and tenant need to sign the agreement. You also need two witnesses to sign. If you’re doing this offline, you’d print the agreement on the e-stamp paper, and everyone would sign with a pen. Simple enough.

But here’s where online gets even better: Aadhaar e-signing. Platforms like eSahayak and eDrafter let you sign digitally using your Aadhaar number. It’s completely legal. It’s actually more secure than physical signatures because it’s linked to biometric data. How does it work?

You upload your agreement to the platform. Both parties receive a link via email or SMS. You click the link, enter your Aadhaar number, and authenticate using OTP. Done. The document gets signed digitally. Your witnesses can do the same thing. The platform then gives you a final PDF with all signatures and the e-stamp embedded.

Some people still prefer physical signatures. That’s fine too. Print the agreement, sign it, scan it, and keep digital copies. Either way, make sure everyone gets a copy. Landlord keeps one. Tenant keeps one. And it’s smart to keep a digital backup in cloud storage like Google Drive or Dropbox. I cannot stress this enough: keep your copies safe. You’ll need them for GST registration, address proof, bank loans, HRA claims, and possibly legal disputes.

Step 4: Register (If Applicable)

If your lease is 11 months or less, you can skip this step. You’re done. But if your agreement is for 12 months or longer, you legally need to register it.

Here’s what registration involves: You (or both parties) need to visit the Sub-Registrar Office in Panchkula. Sector 1 or Sector 8, your choice. Or you can start the process online through Haryana’s registration portal.

What to bring: The signed rent agreement. Your e-stamp certificate. Property ownership proof (sale deed, property tax receipt). ID proofs for landlord and tenant (Aadhaar, PAN card). Your two witnesses, with their ID proofs. Passport-size photos.

At the office, you’ll fill out some forms. Submit your documents. The registrar will verify everything. Both parties will sign in front of the registrar. Witnesses will sign too. You’ll pay a registration fee. This is usually between ₹100 and ₹1,000, depending on the rent amount and lease duration.

The registrar stamps the document and makes an official entry in the government records. You get a registered copy. This is now a public document. It has more legal weight than an unregistered agreement.

Why bother with registration? Because unregistered agreements longer than 11 months can’t be used as primary evidence in court. If there’s ever a dispute, you’d have trouble proving your case. Registration protects you. It takes a few hours if you go in person. Maybe a day or two if you do it online.

Step 5: Verify and Store

Last step, but important. Go back to the e-GRAS Haryana website. There’s a verification section. Enter your e-stamp certificate number. The system will show you whether it’s genuine. Why verify? Because fraud exists. Fake stamp papers exist. By verifying online, you confirm that your stamp duty was actually paid and recorded in government systems.

It takes two minutes. Do it. Then, organize your storage. Keep both physical and digital copies. If you have a physical copy, store it in a folder with other important documents. Not just lying around somewhere you’ll forget. For digital copies, here’s what I do: one copy in email (send it to yourself), one in Google Drive or Dropbox, and one on your phone or laptop. Redundancy is your friend.

Why all this caution? Because you’ll need this document. When your tenant moves out and you’re returning the deposit. When you’re filing taxes and claiming rental income. When your tenant needs address proof for a bank account or driver’s license. When there’s any dispute about rent, maintenance, or damage. A well-organized document system saves you headaches later. Trust me on this.

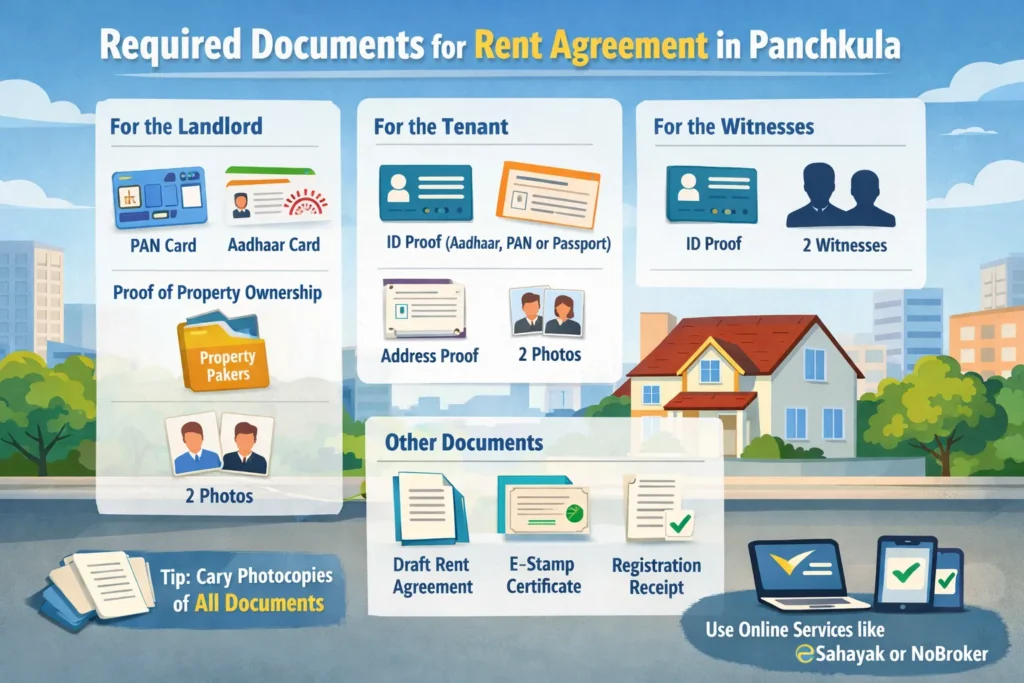

Required Documents for Rent Agreement in Panchkula

Let me give you a complete checklist so you don’t forget anything. Nothing worse than showing up and realizing you’re missing something crucial.

For the Landlord:

PAN card (mandatory for tax purposes). Aadhaar card (for identification and e-signing). Proof of property ownership. This could be your sale deed, property tax receipt, or municipal records. Passport-size photo (usually 2 copies).

For the Tenant:

Aadhaar card, PAN card, or passport (any government ID works). Address proof. This could be a utility bill, driving license, or voter ID from your previous address. Passport-size photos (2 copies).

For Witnesses:

ID proof. Aadhaar or any government-issued ID. You need two witnesses, so two sets of documents.

Other Documents:

The draft rent agreement (Word or PDF format before printing). E-stamp certificate (after you’ve paid stamp duty). Registration receipt (only if you’re registering).

Here’s a tip I learned the hard way: make photocopies of everything. Keep one set for yourself. When my cousin went to register his agreement, they asked for copies and he only had originals. Had to find a photocopy shop nearby. Small hassle, but avoidable.

Also, if you’re using an online service like eSahayak or NoBroker, they usually provide a checklist. Follow it exactly. These platforms have done this thousands of times. They know what works.

Rent Agreement Charges in Panchkula

Let’s talk money. What will this actually cost you?

| Item | Cost Estimate | Notes |

|---|---|---|

| Stamp Duty | ₹100 to ₹200 or 0.5% of rent | Pay via e-GRAS portal |

| Registration Fee | ₹100 to ₹1,000 | Only for leases over 11 months |

| Online Service Fee | ₹1,000 to ₹2,000 | Optional (eSahayak, eDrafter, etc.) |

| Time Required | 1 to 3 days | Includes drafting, e-stamp, and signing |

So realistically, if you’re doing an 11-month agreement, you’re looking at around ₹1,000 to ₹2,500 total. That’s if you use an online service.

If you do it yourself with just a template, it could be as low as ₹500 to ₹1,000 (just stamp duty and maybe template cost).

Compare that to the offline method, which could easily cost ₹2,000 to ₹3,500 when you factor in agent fees, notary charges, and running around.

The online route is cheaper and faster. That’s rare.

Free vs Paid Rent Agreement Services in Panchkula

You have options. Let me break them down.

Free DIY Method:

Download a template online. Fill it in yourself. Pay stamp duty through e-GRAS. Print and sign physically or use Aadhaar e-sign.

Total cost: Just the stamp duty (₹100 to ₹1,200 depending on rent).

Who’s this good for? People who are comfortable with documents and legal language. Basic, short-term rentals. Anyone on a tight budget.

The downside? You’re responsible for getting everything right. If you miss a clause or make a mistake, you could have problems later.

Paid Services:

Companies like eSahayak, AgreementKart, eDrafter, and NoBroker handle everything. They draft the agreement based on your details. They help you pay stamp duty. They arrange e-signing. Some even deliver physical copies to your home.

Total cost: ₹1,000 to ₹2,500 (includes everything).

Who’s this good for? Busy professionals. NRI landlords who aren’t in India. Anyone who wants peace of mind. People renting out property for the first time.

The upside? It’s hassle-free. You’re getting lawyer-reviewed documents. Customer support if you have questions.

You can also check local options through Justdial Panchkula listings. There are local agents who offer similar services, sometimes at lower prices.

My recommendation? If it’s your first time, use a paid service. The ₹1,500 you spend is worth the confidence that everything’s done right. Once you’ve done it once and understand the process, you can go DIY next time if you want.

Common Mistakes to Avoid

I’ve seen people mess this up in predictable ways. Don’t be one of them.

Mistake 1: Using unstamped plain paper.

Some people think they can just print an agreement and sign it. Nope. Without proper stamp duty, your agreement has no legal standing. A court won’t accept it as evidence. Don’t skip the stamp duty.

Mistake 2: Ignoring registration for long-term leases.

If your agreement is longer than 11 months, you must register it. Period. I know it’s an extra step. I know it costs more. But an unregistered long-term lease is basically worthless in a legal dispute.

Mistake 3: Forgetting key clauses.

Notice period, security deposit terms, maintenance responsibilities. These aren’t optional. I know a landlord who didn’t include a notice period clause. When his tenant suddenly left with two weeks’ notice, he had no legal recourse. Don’t let that be you.

Mistake 4: Not verifying the e-stamp.

Just because you paid online doesn’t mean the payment went through correctly. Always verify your e-stamp number at egras.gov.in. Takes one minute. Could save you major problems.

Mistake 5: Skipping witness details.

Your agreement needs two witnesses with proper ID proof. Not just anyone. People who can be contacted if there’s an issue. I’ve seen agreements rejected because witness information was incomplete.

Mistake 6: No copies or backups.

Both parties need copies. Digital backups are essential. If your only copy gets damaged or lost, recreating it is a nightmare.

Pro tip: Always double-check your e-stamp number at egras.gov.in for validity. Seriously. Do it right after you get the certificate. Better safe than sorry.

Frequently Asked Questions

Is an 11-month rent agreement valid in Panchkula?

Yes, absolutely. It’s legally valid if it’s executed on proper stamp paper (or e-stamp). You don’t need to register it. Courts, banks, and government offices all accept it. This is the most common type of rental agreement in India.

How much stamp duty do I need to pay?

Usually ₹100 or 0.5% of your total annual rent, whichever amount is higher. So if your yearly rent is ₹2,00,000, you’d pay ₹1,000 (which is 0.5%). But if your yearly rent is only ₹10,000, you’d still pay the minimum of ₹100.

Can the entire process be done online?

Drafting, e-stamp payment, and e-signing can all be done completely online without leaving your house. Registration (for leases over 11 months) usually still requires at least one visit to the Sub-Registrar Office, though Haryana is working on making that online too.

What happens if I don’t register a long-term lease?

Legally, you’re required to register any lease longer than 11 months. If you don’t, the agreement won’t be admissible as primary evidence in court if there’s a dispute. You can still use it, but it won’t have the same legal weight. Plus, you could face penalties.

Where can I make a rent agreement online?

eSahayak, AgreementKart, eDrafter, and NoBroker all provide Haryana-compliant rent agreement services. They guide you through the process, handle the e-stamp, and arrange digital signing. Prices range from ₹1,000 to ₹2,500.

Do both parties need to be present physically?

Not anymore. With e-signing through Aadhaar, both landlord and tenant can sign from different locations. Same with witnesses. The only time you need to be together is if you’re registering the agreement at the SRO.

Is a rental agreement the same as a lease agreement?

Technically, they’re slightly different. A lease usually refers to longer durations and gives more rights to the tenant. A rental agreement is typically shorter term. But in everyday language, people use the terms interchangeably. For an 11-month agreement, “rent agreement” or “rental agreement” is more common.

Final Thoughts

Creating an online rent agreement in Panchkula isn’t complicated. It’s actually surprisingly straightforward once you know the steps. You draft the agreement (or use a service). You pay stamp duty online through e-GRAS. You sign digitally or physically. If it’s longer than 11 months, you register it. Done.

The whole thing takes 1 to 3 days and costs ₹1,000 to ₹2,500. Compare that to the old way, which took over a week and involved multiple office visits. The key is just understanding Haryana’s specific rules, having your documents ready, and following the process step by step.

Whether you’re a landlord renting out your property or a tenant moving into a new place, do this right. A proper rent agreement protects both of you. It prevents misunderstandings. It gives you legal backing if something goes wrong.

Also Read: How to make Online Rent Agreement in Mohali

Also Read: Commercial Rent Agreement Format

Pryank Agrawal is the Founder and CEO of Housewise, a leading property management startup serving customers across 45 countries with operations in 22 Indian cities, including Pune, Bengaluru, Hyderabad, Chennai, Delhi NCR, and Mumbai. An engineering graduate from IIT Roorkee, Pryank brings extensive experience from the software industry. His passion for leveraging technology to solve real estate challenges led him to establish Housewise, simplifying property management for homeowners worldwide. After persistent requests from existing customers to address other challenges faced by Non-Resident Indians, he founded MostlyNRI, a dedicated portal assisting NRIs with taxation and financial asset management in India.