How to make Online Rent Agreement in Chennai

Imagine this. You finally found the perfect tenant for your Chennai apartment. Or you discovered a great flat in T Nagar within your budget. You shake hands, everything is settled. Now, you need the rent agreement.

The old way meant visiting a broker, hunting for stamp paper in Mount Road, and then spending half a day in a crowded sub-registrar office. The thought alone is exhausting.

But what if you could do it all from your home? With your phone and a cup of filter coffee in hand?

That is the new reality. Creating an online rent agreement in Chennai is not just easier. It is faster, cheaper, and completely legal. This guide will walk you through every single step. We will cover the stamp duty you actually need to pay, the documents you must have, and how to avoid common pitfalls. Let us get your agreement signed, sealed, and delivered.

Why Online Rent Agreements Are Becoming Popular in Chennai

People in Chennai are practical. They prefer solutions that save time and money. The online rent agreement does both.

Think of it like switching from a physical bank line to net banking. The core function is the same, but the experience is worlds apart. You are dealing with the same legal rules, but the process is fully digital. Your agreement is prepared online, signed with an Aadhaar-based OTP, and stamped electronically. The final legal document is a PDF sent directly to your email.

No more taking time off work. No more worrying about lost paper documents. For landlords living in another city, or even another country, this is a game-changer. Students and working professionals moving to Chennai can also get everything sorted before they even arrive. It brings peace of mind to everyone involved.

Step-by-Step: How to Make Online Rent Agreement in Chennai

The process is straightforward. It is designed to be completed in one sitting, often in less than thirty minutes. Here is a breakdown of what you will do.

First, you fill in the basic details.

This includes the full name, address, and PAN of both the landlord and the tenant. You need to be precise here. Any mistake can cause delays later. I recently helped a friend with this, and we double-checked every spelling against their Aadhaar cards. It saved us a lot of trouble.

Next, you describe the property.

Enter the complete rental address in Chennai. Be specific. Include the door number, street name, area, and pin code. Then, you will input the key financial terms. The monthly rent amount. The security deposit paid. And the duration of the rental period.

Then, you move to the legal part.

The system will calculate the required stamp duty based on the information you provided. You select the duration of the agreement. This is a critical step, which we will explore in more detail later.

After that, you sign it.

This is where the magic happens. Instead of wet signatures, you both use an E-signature. This is done through an Aadhaar-based verification. You enter your Aadhaar number, and an OTP is sent to your registered mobile. You enter the OTP, and the document is legally signed. It is that simple.

Finally, you pay and download.

You pay the total amount online. This includes the stamp duty and any service fee. The moment the payment is confirmed, your agreement is generated. You can download the final, legally valid PDF immediately. You can print copies if you need, but the digital version is just as valid.

Documents Required for Online Rent Agreement in Chennai

You do not need a mountain of paperwork. The list is short and simple. The key is to have clear, scanned copies or good-quality photos of these documents ready before you start.

Here is a clear table of what is needed from each party:

| Document | Landlord | Tenant |

|---|---|---|

| Aadhaar Card | Required | Required |

| PAN Card | Required | Optional |

| Passport Photo | Required | Required |

| Property Ownership Proof | Required | Not Required |

For the landlord, property ownership proof could be the sale deed, the property tax receipt, or the Khata certificate. The goal is to establish that you are the legal owner.

What if the landlord is an NRI? The process still works. The NRI landlord will need a notarized Power of Attorney authorizing a local representative to act on their behalf. This representative can then complete the online process using their own Aadhaar for the E-signature.

The E-signing process itself is secure. It uses the same technology the government uses for its own digital services. You are not just putting a picture of your signature on a PDF. You are verifying your identity through the official UIDAI system.

Stamp Duty and Registration Charges in Chennai (2025)

This is the part that confuses most people. Let us demystify it. Stamp duty is a state tax. It is mandatory to make your rent agreement a legally enforceable document. The amount you pay depends on one main thing: the duration of your agreement.

The rules in Tamil Nadu offer a clever way to simplify the process for most people.

| Agreement Duration | Stamp Duty | Registration Fee |

|---|---|---|

| Up to 11 months | 1% of annual rent + deposit or ₹50 minimum | Nil for 11-month agreements |

| 12 months or more | 1% of total | ₹1,000 approximately |

Let me explain with an example. Suppose your monthly rent is ₹20,000 and the security deposit is ₹200,000.

For an 11-month agreement, the stamp duty is calculated as 1% of one year’s rent plus the deposit. So, that is 1% of (₹240,000 + ₹200,000) = 1% of ₹440,000, which is ₹4,400. Since this is more than ₹50, you pay ₹4,400. The registration fee is zero.

This is why the 11-month agreement is so popular in Chennai. It avoids the mandatory and more expensive registration process. It is a standard, accepted practice.

If your agreement is for 12 months or more, the stamp duty is 1% of the total rent for the entire period. For a 12-month agreement at ₹20,000 per month, that is 1% of ₹240,000, which is ₹2,400. However, you must also pay an additional registration fee of around ₹1,000. So, a longer agreement can sometimes be cheaper on stamp duty but more expensive overall due to registration.

You pay these charges online through the Tamil Nadu government’s TNREGINET portal or other authorized e-stamping platforms. The online service you use will integrate this payment into their flow.

Free Rent Agreement Draft and Downloadable Formats

Before you commit to anything, you might want to see what you are getting. A well-drafted agreement is crucial. It protects both the landlord and the tenant by clearly outlining rights and responsibilities.

Many people look for a free rent agreement format in Word or PDF. They want to see the clauses about notice periods, maintenance charges, and rules for guests.

You can find these formats online. A Word document is useful if you want to make minor edits yourself before using an online service. A PDF format is good for a quick read to understand the standard structure.

But remember, a free draft is just a template. It is a skeleton. The online rental agreement services do more than just give you a template. They take that skeleton and automatically fill in all the details for you. They ensure the stamp duty is calculated correctly and that the final document is legally sound and ready for E-signature.

Using a template is like having the ingredients for a meal. Using a full service is like having a chef prepare the meal for you, ensuring it is cooked perfectly.

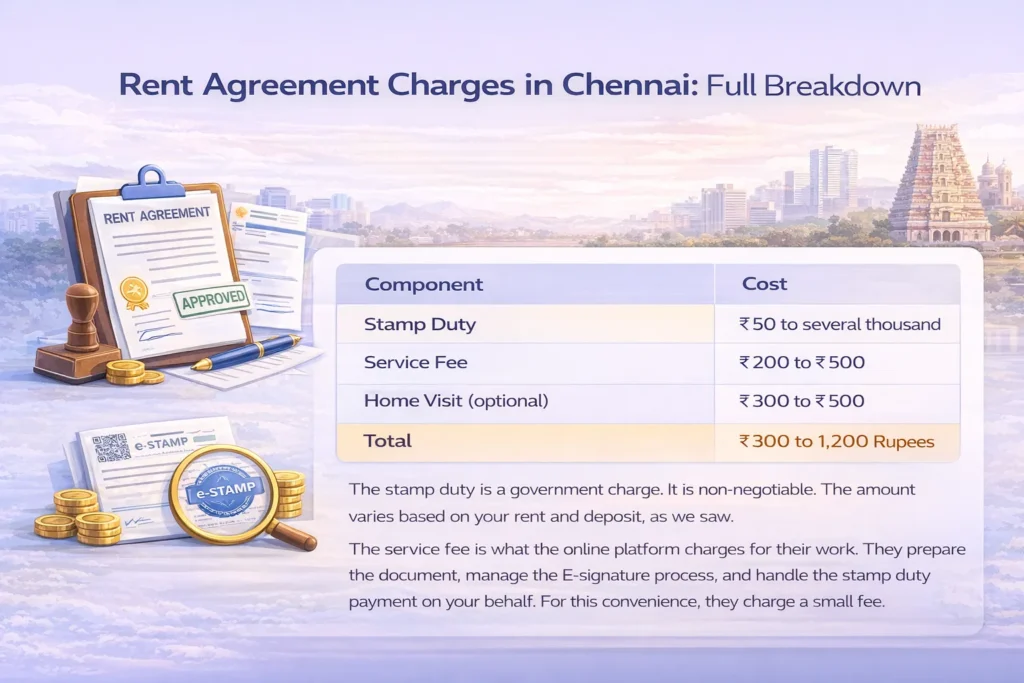

Rent Agreement Charges in Chennai: Full Breakdown

So, what is the final cost? Let us break it down so there are no surprises. The total is not just the stamp duty. It is a combination of a few things.

| Component | Cost |

|---|---|

| Stamp Duty | ₹50 to several thousand |

| Service Fee | ₹200 to ₹500 |

| Home Visit (optional) | ₹300 to ₹500 |

| Total | ₹300 to ₹1,200 approximately |

The stamp duty is a government charge. It is non-negotiable. The amount varies based on your rent and deposit, as we saw.

The service fee is what the online platform charges for their work. They prepare the document, manage the E-signature process, and handle the stamp duty payment on your behalf. For this convenience, they charge a small fee.

Some services offer an optional home visit. A representative comes to collect physical documents or to have you sign something. This is usually not necessary, but it is an option for those who prefer it.

When you add it all up, an online agreement is almost always cheaper than the traditional broker-led method. Brokers often have hidden costs. The online price is transparent and fixed upfront.

Benefits of Online vs Offline Rent Agreements

The difference between the two methods is like night and day. The online method is designed for modern life.

| Online Agreement | Offline Agreement |

|---|---|

| Aadhaar E-sign and E-stamp | Manual signatures and stamp paper |

| Create anywhere, anytime | Registrar office visit mandatory |

| Transparent, fixed charges | Hidden broker costs and fees |

| Fast, often completed in a day | Takes four to seven days typically |

| Legally valid PDF records | Paper documents can be lost or damaged |

The most significant benefit is time. You get your document instantly. There is no waiting. There is no running around. The entire system is built for your convenience. The legal validity is the same, but the process is completely different.

Free Online Rent Agreement in Chennai: What is Actually Free?

You see many websites advertising free rent agreements. It is important to understand what they mean.

The draft format is often free. You can download a standard template for a rental agreement in Word or PDF at no cost. This is useful for review.

However, the stamp duty is never free. It is a government tax. Any service that claims to give you a completely free, legally valid agreement is not being entirely truthful. The legality comes from the stamp duty. Without it, the document is not admissible in court.

What some services do is offer a free draft. Then, if you want them to handle the stamp duty and E-signature process, you pay for that service. This is a fair model. You get to see the draft for free, and you only pay when you decide to make it official.

FAQs About Online Rent Agreements in Chennai

Is an online rent agreement legally valid in Chennai?

Yes, absolutely. The Information Technology Act of 2000 recognizes E-signatures and digital records as legally valid. The E-stamp paper is also approved by the Tamil Nadu government. Your online agreement is as legally binding as a paper one.

What is the stamp duty for an 11-month agreement?

For an 11-month agreement, the stamp duty is 1% of the total of one year’s rent plus the security deposit. There is no registration fee for agreements of less than 12 months.

Can NRIs make rent agreements online?

Yes. An NRI landlord can execute a Power of Attorney in favor of a local representative. This representative can then use their own Aadhaar card to complete the online agreement process on the landlord’s behalf.

How do I download the PDF or Word format?

Most online platforms provide a download link immediately after payment is processed. The final, stamped, and signed agreement is delivered as a PDF. Word formats are usually available as free, unstamped drafts.

Do I need to visit any government office?

No. The entire process, from document preparation to stamp duty payment and E-signature, is completed online. There is no need to visit the sub-registrar office for agreements under 12 months.

How long does the entire process take?

From start to finish, it can be done in one sitting. Once both parties have provided their details and E-signed, the agreement is generated instantly. The entire process can be completed in under an hour if all documents are ready.

Also Read: How to make Online Rent Agreement in Ahmedabad

Pryank Agrawal is the Founder and CEO of Housewise, a leading property management startup serving customers across 45 countries with operations in 22 Indian cities, including Pune, Bengaluru, Hyderabad, Chennai, Delhi NCR, and Mumbai. An engineering graduate from IIT Roorkee, Pryank brings extensive experience from the software industry. His passion for leveraging technology to solve real estate challenges led him to establish Housewise, simplifying property management for homeowners worldwide. After persistent requests from existing customers to address other challenges faced by Non-Resident Indians, he founded MostlyNRI, a dedicated portal assisting NRIs with taxation and financial asset management in India.