Rent Agreement for Commercial Properties in Maharashtra

Maharashtra Rent Control Act, Section 55

In Maharashtra, the legal framework governing commercial rent agreements is primarily outlined in the Maharashtra Rent Control Act, specifically Section 55. This section mandates that any agreement related to the leave and license of a property must be in writing and registered. This legal requirement ensures that both landlords and tenants are protected under the law, and it helps to prevent disputes by providing a clear, legally binding document.

Registration Act & Leave-and-License Rules

The Registration Act further reinforces the necessity of registering commercial rent agreements. According to this act, any lease agreement for a term exceeding 11 months must be registered. The Leave-and-License Rules in Maharashtra also stipulate that even agreements for shorter durations should be registered to ensure legal enforceability. Registration provides a layer of security and authenticity to the agreement, making it admissible in court if disputes arise.

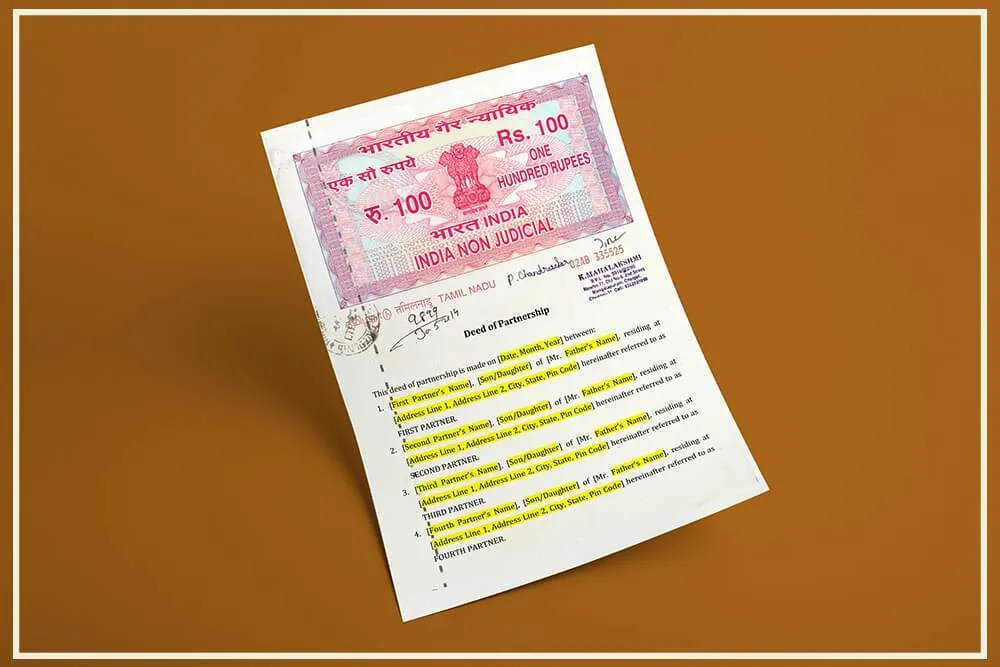

Stamp Duty & Registration Charges for Commercial Agreements

How to Calculate Stamp Duty (Formula & Examples)

Stamp duty is a crucial aspect of commercial rent agreements in Maharashtra. The stamp duty is calculated as 0.25% of the total rent, deposit, and interest for leave and license agreements up to 60 months. For example, if the total rent for the lease period is ₹5,00,000, the deposit is ₹2,00,000, and the interest is ₹50,000, the stamp duty would be calculated as follows:

Total Amount = Rent + Deposit + Interest = ₹5,00,000 + ₹2,00,000 + ₹50,000 = ₹7,50,000

Stamp Duty = 0.25% of Total Amount = 0.0025 * ₹7,50,000 = ₹1,875

Registration Fee & E-Stamping Rules

The registration fee for commercial rent agreements in urban areas is ₹1,000, while in rural areas, it is ₹500. The process of paying stamp duty has been simplified with the introduction of e-stamping. E-stamping allows you to pay the stamp duty online through the Maharashtra e-filing portal. This system ensures transparency and reduces the chances of fraud.

Urban vs. Rural Charges

It’s important to note that the charges for stamp duty and registration fees differ between urban and rural areas. Urban areas typically have higher fees due to the higher value of properties and the increased demand for commercial spaces. Rural areas, on the other hand, have lower fees to encourage development and leasing of commercial properties.

What Should a Commercial Rent Agreement Include?

Parties’ Details and Property Description

A commercial rent agreement should begin with the details of the parties involved, including the landlord and the tenant. This section should include full names, addresses, and contact information. Additionally, a detailed description of the property should be provided, including the address, size, and any specific features or amenities.

Rent, Deposit, Lock-in, Renewal Terms

The agreement should clearly outline the rent amount, the deposit required, and the terms for lock-in periods and renewal. The rent amount should be specified along with the due date for payment each month. The deposit amount should be clearly stated, along with the conditions under which it will be refunded. Lock-in periods, during which neither party can terminate the agreement, should be specified, as well as the terms for renewal at the end of the lease period.

Repairs, Utilities, GST & Other Clauses

The agreement should also include clauses related to repairs and maintenance, utilities, and GST. It should specify who is responsible for repairs and maintenance of the property, and how these costs will be handled. The agreement should outline the responsibilities for paying utilities such as electricity, water, and internet. Additionally, any applicable GST should be clearly stated, along with who is responsible for paying it.

Electricity, Maintenance, Exit Conditions

Specific clauses related to electricity, maintenance, and exit conditions should be included. The agreement should specify how electricity bills will be handled, including whether they are included in the rent or paid separately by the tenant. Maintenance responsibilities should be clearly outlined, including who is responsible for routine maintenance and major repairs. Exit conditions should specify the notice period required for termination of the agreement and any penalties for early termination.

Step-by-Step Registration Process (2025 Online Portal)

How to E-Stamp on Maharashtra e-filing portal

The process of registering a commercial rent agreement in Maharashtra has been streamlined with the introduction of the online portal. To begin, you need to pay the stamp duty through the Maharashtra e-filing portal. This involves creating an account, entering the details of the agreement, and making the payment online. Once the payment is confirmed, you will receive an e-stamp certificate.

Booking Sub-Registrar Appointment

After obtaining the e-stamp certificate, the next step is to book an appointment with the Sub-Registrar. This can be done online through the Maharashtra e-filing portal. You will need to select a convenient date and time for the appointment and provide the details of the parties involved in the agreement.

Required Documents & Signatures

On the day of the appointment, you will need to bring the original documents, including the e-stamp certificate, the rent agreement, and identification proofs of the parties involved. The Sub-Registrar will verify the documents and witness the signing of the agreement. Once the agreement is signed and registered, you will receive a registered copy of the agreement, which is legally binding and admissible in court.

Sample Clause Highlights for Commercial Use

Including sample clauses in your commercial rent agreement can help ensure that all important aspects are covered. Here are some sample clauses that you might consider including:

Rent Payment Clause

“The tenant agrees to pay a monthly rent of ₹[amount] on the 2026 of each month. The rent shall be paid via [payment method] to the landlord’s account.”

Maintenance Clause

“The landlord shall be responsible for major repairs and structural maintenance of the property. The tenant shall be responsible for routine maintenance and minor repairs.”

Termination Clause

“Either party may terminate this agreement by giving [number] months’ written notice to the other party. In the event of early termination by the tenant, a penalty of [amount] shall be payable to the landlord.”

Who Pays What? Stamp, Registration & Drafting Fees

The costs associated with stamp duty, registration fees, and drafting fees are typically shared between the landlord and the tenant. However, it is important to clearly outline these responsibilities in the agreement to avoid any disputes. Here is a typical breakdown of who pays what:

Stamp Duty

Stamp duty is usually shared equally between the landlord and the tenant. However, this can be negotiated and specified in the agreement.

Registration Fees

Registration fees are also typically shared equally between the landlord and the tenant. Again, this can be negotiated and specified in the agreement.

Drafting Fees

Drafting fees for the agreement are usually paid by the party who initiates the drafting process. This can be either the landlord or the tenant, depending on who takes the lead in preparing the agreement.

Common Pitfalls & How to Avoid Them

There are several common pitfalls that parties should be aware of when drafting and registering a commercial rent agreement. Here are some of the most common issues and how to avoid them:

Incomplete or Unenforceable Clauses

One of the most common pitfalls is including incomplete or unenforceable clauses in the agreement. To avoid this, it is important to ensure that all clauses are clearly written and legally enforceable. Consulting with a legal expert can help ensure that the agreement is comprehensive and legally sound.

Surprises Around Online Filing and Appointment Scheduling

Another common issue is surprises around the online filing and appointment scheduling process. To avoid this, it is important to familiarize yourself with the Maharashtra e-filing portal and the steps involved in the registration process. Booking appointments well in advance can help ensure a smooth process.

Risk of Non-Legal Enforceability or Registration Failure

There is always a risk of non-legal enforceability or registration failure if the agreement is not properly drafted and registered. To avoid this, it is crucial to follow all legal requirements and ensure that the agreement is registered with the Sub-Registrar. Consulting with a legal expert can help ensure that the agreement is legally enforceable.

FAQs

Is rent agreement mandatory over 11 months in Maharashtra?

Yes, according to the Maharashtra Rent Control Act, any lease agreement for a term exceeding 11 months must be registered. This ensures legal enforceability and protection for both parties.

Can notarization substitute registration?

No, notarization cannot substitute registration. While notarization provides a layer of authenticity, it does not provide the same legal enforceability as registration. Only registered agreements are admissible in court.

How are deposits treated for stamp duty?

Deposits are treated as part of the total amount for calculating stamp duty. The stamp duty is calculated as 0.25% of the total rent, deposit, and interest for leave and license agreements up to 60 months.

Penalties for non-registration

The penalties for non-registration of a commercial rent agreement can include legal disputes, non-enforceability of the agreement, and potential financial penalties. It is crucial to register the agreement to ensure legal protection and enforceability.

Quick Reference Table & Checklist

Quick Reference Table

| Item | Urban | Rural |

|---|---|---|

| Stamp Duty | 0.25% of total rent, deposit, and interest | 0.25% of total rent, deposit, and interest |

| Registration Fee | ₹1,000 | ₹500 |

| E-Stamping | Mandatory | Mandatory |

Checklist

- Draft the Agreement: Include all necessary clauses and details.

- Calculate Stamp Duty: Use the formula provided to calculate the stamp duty.

- Pay Stamp Duty: Use the Maharashtra e-filing portal to pay the stamp duty and obtain the e-stamp certificate.

- Book Appointment: Book an appointment with the Sub-Registrar through the Maharashtra e-filing portal.

- Gather Documents: Collect all original documents, including the e-stamp certificate, rent agreement, and identification proofs.

- Attend Appointment: Attend the appointment with the Sub-Registrar to sign and register the agreement.

- Receive Registered Copy: Obtain the registered copy of the agreement, which is legally binding and admissible in court.

By following this guide, you can ensure that your commercial rent agreement in Maharashtra is legally sound, comprehensive, and enforceable.

Pryank Agrawal is the Founder and CEO of Housewise, a leading property management startup serving customers across 45 countries with operations in 22 Indian cities, including Pune, Bengaluru, Hyderabad, Chennai, Delhi NCR, and Mumbai. An engineering graduate from IIT Roorkee, Pryank brings extensive experience from the software industry. His passion for leveraging technology to solve real estate challenges led him to establish Housewise, simplifying property management for homeowners worldwide. After persistent requests from existing customers to address other challenges faced by Non-Resident Indians, he founded MostlyNRI, a dedicated portal assisting NRIs with taxation and financial asset management in India.